- ॐ, Home

- >>

- US

- >>

- Finance

- >>

- Investment

- >>

- Coupon Rate

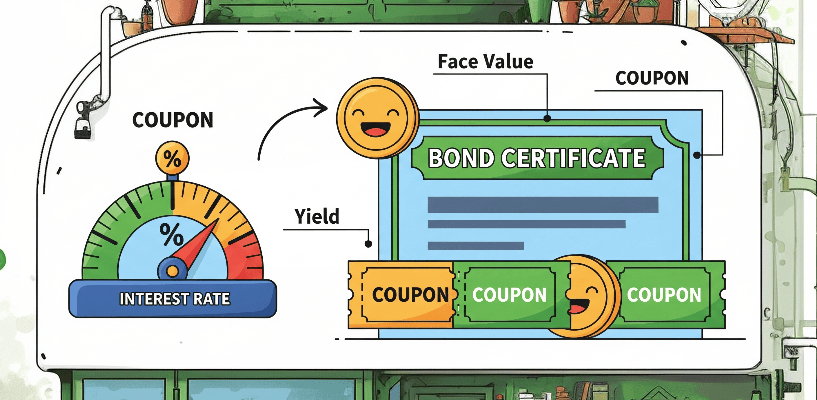

Coupon Rate

It’s called the “coupon rate” because, in the past, physical bonds had paper coupons attached to them. Investors would literally clip these coupons and “mail them to the issuer” to receive their interest payments. Even though payments are now electronic and most bonds are book-entry (no physical paper), we still call “the annual interest the coupon” and the percentage the coupon rate.

The Formula:

“Annual Interest Payment = Face Value of the Bond × Coupon Rate”

Key Example (a bond with “a Face Value of $1,000” and “a Coupon Rate of 5%”):

“Annual Interest Payment = $1,000 × 5% = $50 per year”

“Coupon-bearing bonds” pay periodic interest; “zero-coupon bonds” pay no periodic coupons and are sold at a discount instead.

Types of Coupon Rates -

Fixed-rate coupon -

- What: A constant percentage of “par” paid periodically for the life of the bond.

- Example: 5% on $1,000 par → $50 per year (if semi-annual: $25 every six months).

- Pros: Predictable income. Easy to value.

- Cons: Loses value if market rates rise (price falls). E.g., a 5% return is not good if inflation is 7%.

Floating-rate coupon (FRN — floating-rate note) -

- What: “Coupon rate = a reference/benchmark rate (e.g., SOFR, 3-month rate) + a fixed spread (margin).” ‘Reference rate’ is the variable part of the ‘coupon rate.’

- Reset Date / Frequency: The predetermined intervals at which the coupon rate is recalculated. This is often quarterly or semi-annually. The new rate is typically ‘determined in advance’ and paid at the end of the coupon period — i.e., paid in arrears.

- Example: “Reference + 1%” (if reference = 2% then coupon rate = 3% that period).

- Pros: Less interest-rate risk; coupon rises with market rates.

- Cons: Income is variable/uncertain; complexity in valuing accruals.

Zero-coupon (no periodic coupon) -

- What: Pays no periodic interest; issued at a discount and redeems at par at maturity. (Technically has no “coupon rate” but is often discussed alongside coupons.)

- Example: Buy for $800 a zero-coupon bond with a face value of $1,000 and a 5-year maturity. You receive no payments for 5 years. At maturity, you receive $1,000.

- Pros: Simple lump-sum at maturity, useful for matching future liabilities. (You know the exact value you will receive on a specific date.)

- Cons: No periodic cash-flow/income; price is sensitive to interest-rate Imputed interest is typically “taxed annually” (in many jurisdictions) as it accrues (phantom income).

Step-up / Step-down rate coupon -

- What: Coupon starts at one rate and steps up (or down) to a different rate at “pre-set dates.” The step could be ‘a one-time event’ or “occur multiple times” throughout the bond’s life.

- Example: A company issues a 7-year step-up Years 1-3 → Investors receive a 3% annual “coupon rate.” Year 4 → On the anniversary date, the coupon automatically “steps up” to 5%. Years 4-7 → Investors receive a 5% annual coupon for the remaining life of the bond.

- Pros: Issuers can offer lower initial coupons; investors get higher later if specified. (An issuer might use a step-up coupon if they expect their ‘revenue or profitability’ to increase in the future.)

- Cons: Complexity; value depends on future step schedule. (“Reinvestment risk in step-down” → when the coupon decreases, you must reinvest that lower amount of interest at potentially lower market rates.)

Indexed / inflation-linked coupon -

- What: Coupon (or principal) is tied to an inflation index (e.g., CPI). The bond’s principal value is periodically adjusted (e.g., semi-annually) based on the change in the CPI. The coupon rate (the “real” yield) is fixed, but it is applied to the adjusted principal. Therefore, as “the principal” grows with inflation, the dollar amount of the interest payment also grows.

- Example: You buy a $1,000 inflation-linked bond with a 2% real coupon. Assume annual inflation is 3%. Thus, year 1 coupon payment → $20.60 (2% * $1,030) (“$1,000 * 3% + $1,000” → $1,030). Year 2 coupon payment → $21.22 (2% * $1,060.9) (“$1,030 * 3% + $1,030” → $1,060.9).

- Pros: Protects real purchasing power.

- Cons: More complex, may have lower nominal coupons. (Having “a lower state (nominal) coupon rate” because the returns are expected from inflation.)

Payment-in-kind (PIK) rate coupon -

- What: A PIK coupon is a feature on some bonds (and loans) where the issuer does not pay ‘interest in cash’ on the interest payment date. Instead, they “pay” the interest by issuing more of the same bond, which increases the principal amount owed.

- Example: A $1,000 bond with “a 10% PIK coupon rate” that matures in 3 years. End of Year 1 → “New Principal = $1,000 + $100 = $1,100”. End of Year 2 → “New Principal = $1,100 + $110 = $1,210”. End of Year 3 (Maturity) → “Total Payout = $1,210 (in cash)”. Gain of $210.

- Pros: Conserves issuer cash. The higher yield appeals to specialized investors.

- Cons: Interest compounds (if the issuer eventually runs into trouble, the investor’s total loss is larger). Also, in a company’s capital structure, PIK notes are often explicitly subordinated to other debt (like bank loans or senior secured notes). This means in “a bankruptcy or liquidation,” PIK holders are among the last to be paid.

Range-accrual rate coupon -

- What: A range accrual note pays a coupon that “accrues” only on the days a specified reference rate (e.g., SOFR, EURIBOR) stays within a pre-defined range. The coupon is not fixed but is calculated based on the number of days the condition is met.

- Mechanism: The note has “a reference rate, a lower bound, and an upper bound.”

- Example: Notional → $1,000,000. Term → 1 Year (360 days). Reference Rate → SOFR. Range → “1% to 3%”. Maximum Coupon Rate → “6% per annum”. If SOFR stays within the 1-3% range for 300 days of the year, the investor earns → “$1,000,000 × 6% × (300/360) = $50,000”. If the rate is outside the range for the entire period, the coupon is zero.

- Pros: Enhanced yield; view-driven investment.

- Cons: Path dependency; binary risk; liquidity risk.

Inverse floater (reverse floater) rate coupon -

- What: An inverse floater is a bond whose coupon moves “inversely” to a reference interest rate. When the reference rate goes down, the coupon payment goes up, and vice-versa.

- Example: Notional → $1,000,000. Reference Rate → SOFR. Formula → “8% – (2 × SOFR)”. If SOFR is 1%, the coupon rate is “8% – (2 × 1%) = 6%”. If SOFR rises to 3%, the coupon rate falls to “8% – (2 × 3%) = 2%”. If SOFR rises to 4.5%, the coupon rate is effectively “8% – 9% = 0%” (most structures have a floor of 0%).

- Pros: Highly leveraged bet on falling rates; high initial coupon.

- Cons: Large downside if rates rise; extreme price volatility; calculation complexity.

Coupons affected by embedded options (callable / putable / convertible) -

- Callable: The issuer has the right, but not the obligation, to “call or redeem” the bond back from investors before its maturity date. To compensate for this unwanted risk, investors demand “a higher yield” (and thus ‘a higher coupon’) upfront.

- Putable: The investor has the right, but not the obligation, to “put or sell” the bond back to the issuer before This is typically done when interest rates rise, allowing the investor to get their principal back and reinvest it at ‘a higher, more’ attractive rate. The issuer can offer a lower coupon upfront.

- Convertible: The investor has the right to convert the bond into a predetermined number of shares of the issuer’s common stock. Investors are willing to “sacrifice yield” (accept a lower coupon) because they participate in the potential capital appreciation of the stock.

Coupon Rate vs Yield -

The Coupon is about the issuer’s promise. It’s the contractual formula for calculating the next interest payment.

The Yield is about the investor’s return. It’s the effective annual rate of return you get, based on the price you paid. (The investor’s “annualized rate of return” based on the market price.)

Key Example:

- Bond: Face $1,000, coupon rate 5% → “annual coupon = $1,000 × 5% = $50”. Bought at $1,000 → “yield = $50 / $1,000 = 5.00%”.

- Same bond (coupon $50), bought at $900 → “yield = $50 / $900 = 0.0555… = 5.56%”.

- Same bond (coupon $50), bought at $1,100 → “yield = $50 / $1,100 = 0.04545… = 4.55%”.

- Two-year example (shows price effect on YTM briefly): Face 1,000, coupon 5% ($50/year), bought at $900, held to maturity in 1 year (so total receive $1,050) → “YTM = ($1,050 − $900) / $900 = $150/$900 = 0.16666… = 16.67%”. This “16.67%” is your total return for holding the bond for that one-year period. It’s so high because you captured both “the coupon payment” and “the gain from the bond’s price rising from $900 to its $1,000 face value.”

That’s all friends.

Suggestions or corrections for this page can be submitted from the “contact us” page.

Ads Section