- ॐ, Home

- >>

- US

- >>

- Technology

- >>

- Software

- >>

- Tip Screen

Tip Screen

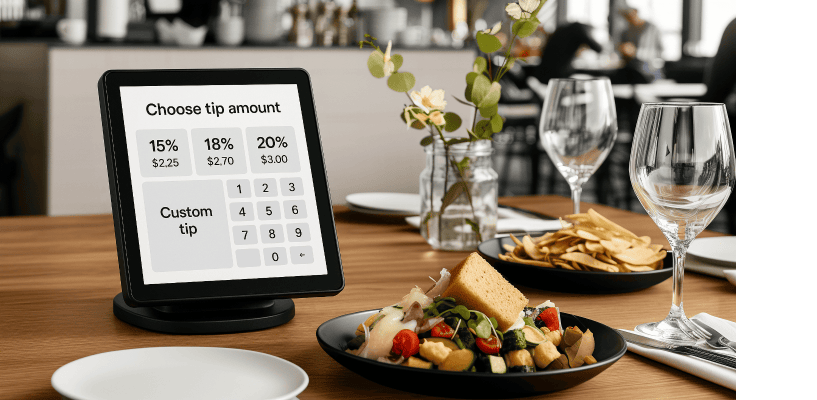

A tip screen (also called a ‘tip prompt’) is the on‑screen interface element that appears during the payment flow — typically on a restaurant’s countertop POS terminal, a handheld payment device, or a mobile‑pay app — inviting the customer to add a gratuity/tip before finalizing the bill. A POS (Point of Sale) system is a ‘comprehensive technology solution’ that facilitates transactions at the point where a customer completes a purchase.

The ‘tip screen’ is a software feature integrated into the POS interface. It appears on the POS hardware (e.g., a card reader screen, tablet, or terminal-display) during payment, allowing customers to select a tip amount before completing the transaction.

From a business perspective, these digital systems do more than just collect tips — they generate valuable data. Insights into tipping behavior can help owners assess “customer preferences, optimize service, and even evaluate employee performance.”

Key Characteristics -

Placement in the flow -

Shown immediately after the bill total is presented but before the transaction is closed (i.e., before “Swipe/Insert Card” or “Confirm Payment”). A POS system handles payment processing, and modern systems often include software features like “tip screen.” The hardware (e.g., touchscreen terminal, tablet, or customer-facing display) is designed to run this software as part of the transaction flow.

Device types -

- Fixed POS terminals (e.g., Verifone, Ingenico, etc.) with customer-facing screens.

- Mobile card readers attached to “tablets or phones” (Square, Toast, Clover devices, Stripe Reader, etc.).

- Smartphone or tablet apps (food‑delivery, ride‑hailing, mobile ordering, etc.).

- Even handheld POS devices used in “restaurants or salons” often include ‘tip prompt’ feature.

User Interface patterns -

- Preset options: Commonly 10%, 15%, 18%, and 20% (sometimes with an “Other” field). Calculated against the bill total.

- Custom entry: Lets the user type in any percentage or dollar amount of their choosing.

- No‑tip/Decline button: Gives the customer a way to bypass adding a tip.

Behavioral impact -

- Studies have shown that presenting ‘higher’ default percentages (e.g. starting at 20%) tends to increase average tip amounts.

- Wording, button placement, and “visual emphasis” (bolding, color highlights) can all influence the customer’s choice.

Regulatory considerations -

- In some jurisdictions (e.g. California), tip screens must clearly label how tips are handled and that they are not service fees.

- Merchants often need to keep records of tip amounts separately from “sales tax or service charges.”

The Psychology Behind the Prompt-

Why do tip screens work so effectively? Behavioral science has some compelling answers:

- Default Bias: People tend to go with pre-set options to avoid decision fatigue. Tip screens leverage this by offering “suggested amounts” (like 10%, 15%, 20%, or 25%), which subtly nudge customers to pick one — often resulting in “higher tips” (than if the customer had to calculate manually).

- Social Pressure: When the transaction is happening face-to-face — especially with a cashier watching — selecting “No Tip” can feel uncomfortable. This subtle social friction encourages many customers to tip, even if they hadn’t planned to.

- Anchoring Effect: By presenting high percentages as default (e.g., starting at 20%), the screen sets an anchor — making smaller tips seem stingy and larger ones feel more normal, which can drive up the average gratuity.

Tipping Guidelines by Industry -

Here is breakdown of tipping norms by industry and almost aligns with widely accepted standards in the U.S. (and many Western countries). However, tipping culture varies globally, and “even within industries, nuances exist.”

Restaurants (Sit-Down) -

Standard Tip: 15–20% of pre-tax bill (20 % is customary for great service; 10% is the bare minimum for adequate service).

Exceptions:

- Fine dining: 20–25% (for personalized service, sommeliers, etc.).

- Large groups: 18–22% (many restaurants auto-add 18–20% gratuity for parties of 6+).

- Buffets: 10% (staff refill drinks and clear plates).

Bars -

Standard Tip: $1–$2 per drink or 15–20% of the tab.

Exceptions:

- Craft cocktails: 20% (labor-intensive orders).

- Open tabs: 20% of the total.

Delivery Drivers -

Standard Tip: 10–15% of the order or $2–$5 minimum (whichever is higher).

Exceptions:

- Bad weather: 20–25% (hazardous conditions).

- Large orders: 15–20% (e.g., catering).

- Apps like “DoorDash/Uber Eats”: Tip upfront in the app (drivers see this before accepting orders).

Housekeeping -

Standard Tip: $2–$5 per night (leave daily, as staff may rotate).

Exceptions:

- Luxury hotels: $5–$10 nightly.

- Leave a note with cash labeled “Housekeeping” to avoid confusion.

Ride Services (Uber/Lyft) -

Standard Tip: 15–20% of fare or $2–$5. In‑app tipping might be available. A ‘$1–$2 min’ is fine on very short rides.

Exceptions:

- Luggage help: Add $1–$2 per bag.

- Exceptional service: 25%+ (e.g., navigating traffic to save time).

Hairdressers/Barbers -

Standard Tip: 15–20% of service cost. Tip on the ‘full cost’ of the cut, color, styling, etc.

Exceptions:

- Salon owners: Not always tipped (ask first).

- Complex services (color/custom styles): 20–25%.

Movers -

Standard Tip: 15–20% of total cost (split evenly among the crew) or “$4–$5 per mover per hour.”

Exceptions:

- Heavy items (pianos, safes): Add $10–$20 per worker.

- Long-distance moves: Tip upon delivery (not upfront).

Valet Parking -

Standard Tip: $2–$5 when retrieving your car. Hand the tip directly to the attendant who brings your car back.

Exceptions:

- High-end venues: $5–$10.

Tour Guides -

Standard Tip: $7–$10 per person per day (group tours) or “10–20% of tour cost” (private guides).

Exceptions:

- Multi-day trips: $15–$25/day.

Spa Services -

Standard: 15–20% of service cost. “Massage, facial, mani/pedi, etc.” — tip each therapist individually if services are separate.

Exceptions:

- Medical spas: No tip expected (services are clinical).

Modern POS Ecosystems -

Today’s POS systems are not just transactional tools but centralized hubs that connect to a web of business-critical “software and services.” The ‘tip screen’ is no longer a static feature — it’s a ‘smart, data-driven’ interface that leverages integrations to optimize both customer experience and business outcomes.

Real-Time Analytics Dashboards -

Tip suggestions are dynamically adjusted using real-time ‘data’ (e.g., bill size, peak hours, or seasonal trends). For example, a higher tip percentage might be suggested “during busy dinner rushes” or for large-group orders.

“Analytics” also tracks tip acceptance rates, helping businesses refine prompts for maximum effectiveness.

Inventory & Order Management -

Tip prompts can factor in order of “complexity” (e.g., customizations, special requests) or “high-margin items” to nudge customers toward generosity.

In restaurants, tips might adjust based on “kitchen wait times” or “table turnover rates” (pulled from inventory/order data). E.g., “Your order had 4 special requests — consider 20% to thank your server!”

CRM & Customer Profiles -

Loyalty program integrations allow personalized tip suggestions. For instance, a repeat customer who historically tips 20% might see that as the default option.

POS systems like ‘Square or Toast’ use purchase history to tailor prompts (e.g., larger tips for high-spending clients).

Customer Feedback Tools -

Post-transaction “surveys or ratings” can influence future tip prompts. A negative feedback event might trigger a more ‘conservative’ tip suggestion to avoid friction.

Some systems even ‘tie’ tip percentages to staff performance metrics (e.g., optimized higher prompts are shown for servers with higher ratings).

Location & Time-Based Logic -

Geolocation data adjusts tip norms by region (e.g., 15% in rural areas vs. 20% in urban hubs).

Time of day matters: a coffee shop might suggest lower tips at 7 AM but higher ones during “evening wine tastings.”

About Tipping Law -

The IRS (Internal Revenue Service) defines tips as taxable income. Employees who receive cash tips must keep a daily record and, if they earn ‘$20 or more’ in tips in any month, report the full amount to their employer by the 10th of the following month. All tips — whether cash, credit‑card, or allocated by the employer — are subject to “federal income tax, Social Security, and Medicare withholding”; state tax treatment may vary.

Under the ‘Fair Labor Standards Act’ (FLSA), employers of “tipped employees” (those who customarily receive over $30/month in tips) may pay a direct cash wage as low as $2.13/hour, provided that the employee’s tips bring their total earnings up to at least the ‘federal minimum wage’ ($7.25/hr). If “tips” plus the “direct wage” don’t meet the required minimum, the employer must make up the difference.

Employers taking a ‘tip credit’ may require participation in a mandatory “traditional” tip pool, but only among staff who “customarily and regularly” receive tips (e.g., servers, bartenders, bussers). “Managers and supervisors” may never keep any portion of those tips.

Compulsory service charges (e.g., a 15% “gratuity” auto‑added for parties of ‘six or more’) are classified as wages, not tips. They must be taxed and subject to withholding like regular pay; customers cannot redirect or adjust “compulsory service charges” (they are part of the bill, like a menu price).

That’s all friends.

Suggestions or corrections for this page can be submitted from the “contact us” page.

Ads Section